“I feel working with multiple advisors for investments, tax preparation, and estate planning creates problems.”

When your investment, tax, and estate planning are part of a unified wealth management strategy, you find peace of mind for the journey ahead.

Using a strategic model in navigating the market can increase and preserve your net worth.

Avoid unexpected penalties and optimize your tax strategies to maximize short and long-term tax savings.

A properly established estate plan will allow you to pass on your legacy quickly and efficiently.

Mark Founded Kanakaris & Associates In Direct Response To An Injustice. When A Beloved Family Member Received Bad Advice From An Advisor And Spent Her Final Years In Poverty, He Was Determined To Protect Others From The Same Misfortune.

“Clients feel the ferocity of our commitment, and they call me the 800-Pound Gorilla for good reason.”

Schedule a consultation with us to learn why.

Mark Kanakaris- Founder & CEO

Is your portfolio not performing? Is it taking too much risk? Know your personal and portfolio risk numbers and develop a strategy you are confident with.

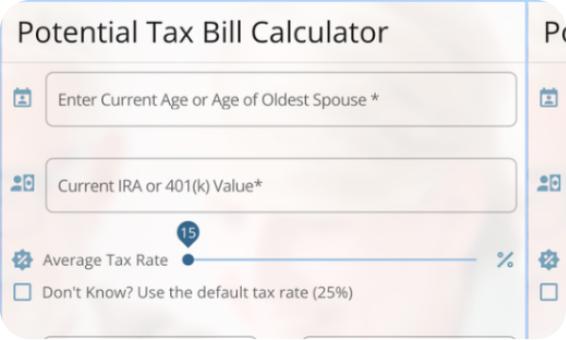

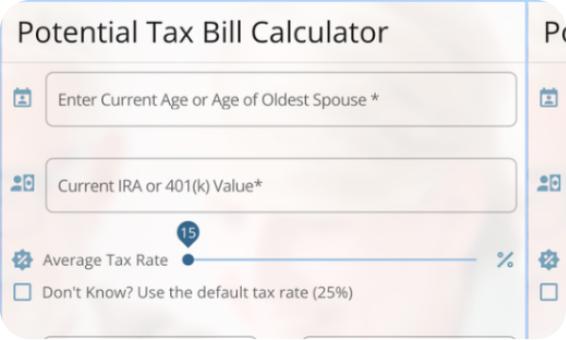

Taxes can consume a great portion of your retirement accounts. Use our free calculator and receive a report in just 30 seconds That shows how much you will pay.

Taxes can consume a great portion of your retirement accounts. Use our free calculator and receive a report in just 30 seconds That shows how much you will pay.

Our Signature Process is designed to leave no stone unturned in defending your financial future.

You’ll get to know us, and we’ll get to know you. We’ll make sure we get a clear view of your current situation and your goals for the future.

Over the course of our next few meetings, we’ll show you what your opportunities are, uncover exposures or risks, and give you a clear idea of how much money you can really have in retirement.

With the right plan in place, we manage your investments and taxes while monitoring your progress closely. Down the road, we adjust your strategy as needed to reach your goals.

These questions and many more like them can only be answered when your investment, tax, and estate plans are woven into a unified wealth management strategic plan.

These and many more questions like them can only be answered when your investment, tax, and estate plans are woven into a unified wealth management strategy.

While we develop your tax strategy as part of your unified wealth management plan, your paperwork and returns are handled by the expert team at our sister company, Cherokee Tax Group. This is included as part of our services. (Ask Us How!)

While we develop your tax strategy as part of your unified wealth management plan, your paperwork and returns are handled by the expert team at our sister company, Cherokee Tax Group. This is included as part of our services. (Ask Us How!)

Understand the top tax strategies we use to increase and preserve your wealth.

Learn the secrets of a Rock Solid Wealth Plan™

Understand the top tax strategies we use to increase and preserve your wealth

Learn the secrets of a Rock Solid Wealth Plan™

The content contained herein is for informational purposes only and does not constitute a solicitation or offer to sell securities or investment advisory services. Investments are not fdic-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. Past performance is not a guarantee of future results and clients should not assume that future performance will be comparable to past performance.

Full disclosure

© 2025 Kanakaris & Associates. All rights reserved. Plain Language Matters | Sitemap | Privacy Policy | Terms of Use

Is it taking too much risk? Know your “risk number” and develop a strategy that is right for you!

We use cookies on our site to ensure you have the best experience with our company. By continuing to use our site, you are agreeing to our privacy policy.